Go beyond coverage. Deliver lasting value that strengthens retention.

Stand out as a true partner by offering your client a modern platform to manage risk and claims more effectively. Strengthen your role as a trusted advisor and deliver value far beyond coverage with Titan.

How Titan Adds Value to Broker-Client Relationships

In a competitive market, brokers need more than competitive rates to retain clients and grow their business. Titan provides the risk management tools that differentiate your service, streamline your operations, and strengthen client relationships through measurable value delivery.

Strengthen Client Retention with Tangible Value

In a market where price alone isn't enough, Titan gives you something better to offer—tools that reduce claims costs, streamline documentation, and help clients respond faster when it matters most.

Simplify Claims Coordination Across Clients and Carriers

Say goodbye to hunting through inboxes. Titan brings all documents, status updates, and financials into one place, so you're not the default claims historian every time something gets missed.

Deliver a Differentiated Client Experience

Clients expect more than quotes. They want help managing risk. Titan supports you in delivering modern, intuitive tools that make your service feel proactive, strategic, and hard to walk away from.

Flexible Access and Support for Your Role

Whether you're front-and-center on a claim or acting as a behind-the-scenes sounding board, Titan flexes to your level of involvement. One login across multiple clients? We've got you covered.

Why Titan Stands Apart

Unlike traditional RMIS platforms, Titan was built from the ground up with a modern user experience and powerful AI capabilities designed to simplify every step of claims and risk management.

No manual data entry or tedious document uploads:

Titan's AI-powered Smart Email Intake automatically captures and organizes claim documents, so nothing slips through the cracks.

Powered natively by AI:

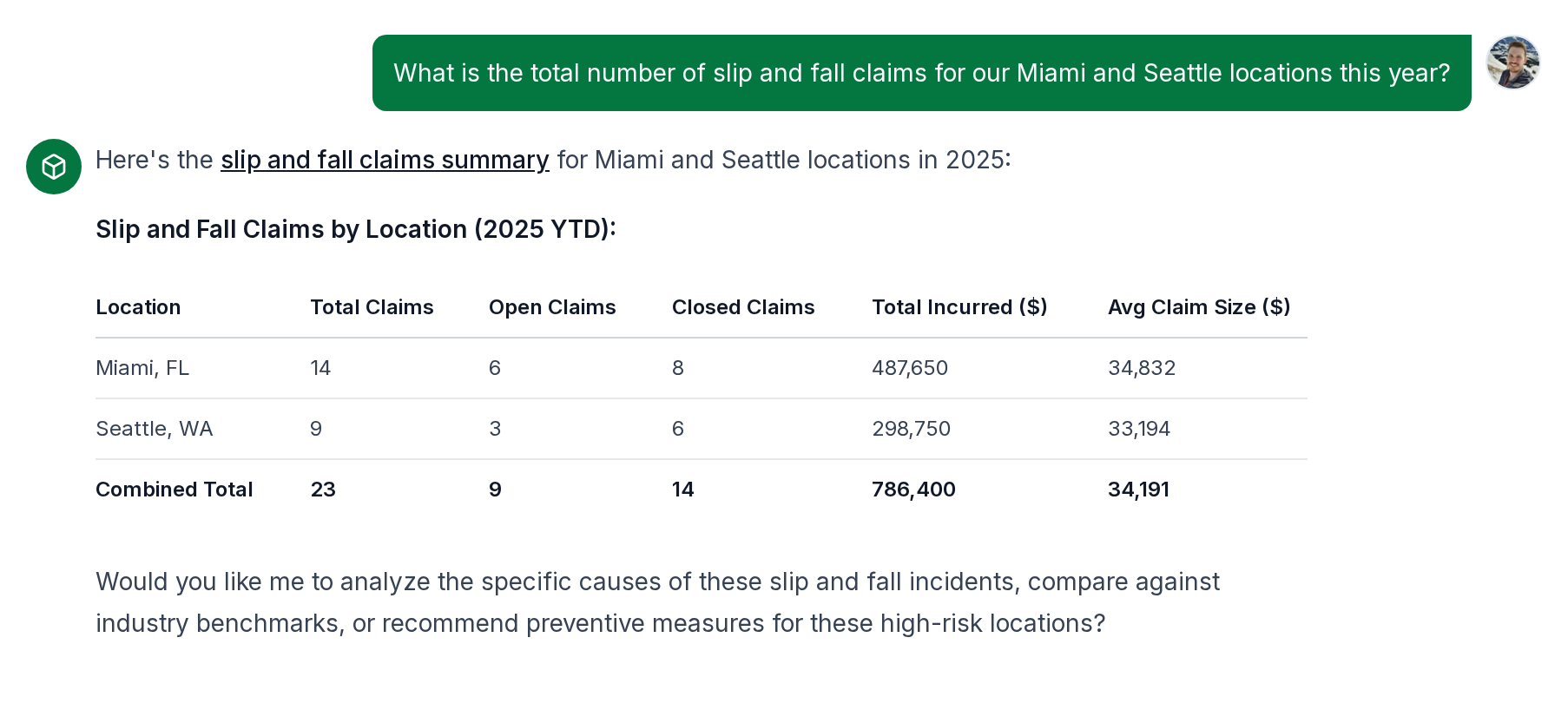

With AI workflows, Titan empowers users to get instant visibility into claim status, financials, and trends without digging through endless files or emails.

Simple, intuitive, and collaborative:

Titan makes it easy for brokers, clients, and advocates to work together seamlessly. No complicated training or clunky workflows.

Built for real-world workflows:

We understand what brokers and their clients need — a platform that flexes to fit their roles and scales with their business.

Ask Titan AI: Instant Case Insights and Risk Analysis

Get immediate answers about client risk patterns, claims history, and strategic opportunities. Identify the strongest arguments for your case and spot emerging problems across your client portfolio before they become expensive claims.

Transform Your Practice, Strengthen Your Relationships

Titan empowers claims advocates to evolve from reactive crisis managers to strategic risk advisors. Stronger client relationships, better case outcomes, and higher fees—all while reducing the administrative burden that limits your growth.

From Crisis Manager to Strategic Advisor

Transform your client relationships from reactive damage control to proactive risk management. Position yourself as an essential business partner who prevents problems and maximizes recoveries when claims do occur.

Maximum Recovery, Minimum Effort

Spend more time negotiating and less time gathering basic facts. Complete case files are automatically assembled from the moment an incident occurs, giving you maximum leverage in every negotiation.

FAQ

Speak with us to discuss how we can tailor a partnership that works best for you.

Ready to Deliver More Value?

Let's explore how Titan can complement your client relationships and boost retention.