Simplify inspections, streamline incident response, and stay on top of claims

Keep property sites safe, reduce claims and stay ahead of risk with Titan, a modern platform built to address the unique inspection, incident and claims challenges of multifamily and commercial operations.

Challenges in Property Management

Managing risk across multiple properties presents unique operational and strategic challenges. From coordinating day-to-day workflows to maintaining defensible documentation, property management teams face complex requirements that demand specialized solutions.

Operational Efficiency

Coordinating inspections, incident reports, and claims across multiple properties requires seamless workflows and connected systems. Without them, teams risk delays, added workload, and disjointed communication.

Litigation Preparedness

When incidents lead to legal action, missing documentation or incomplete records can significantly increase exposure. Maintaining a clear, defensible trail of evidence is critical to protecting the business.

Portfolio-Wide Visibility

Understanding where risk is concentrated across a large property portfolio can be difficult without consistent reporting and centralized data. This limits the ability to proactively address issues before they escalate.

Early Intervention on Claims

Sub-deductible incidents often lack follow-through, leading to missed opportunities for early resolution. Identifying which cases need attention, and taking effective measures against them early on, remains a key challenge for risk teams.

How Titan Helps Property Management Teams

Streamline operations across your entire portfolio with unified incident reporting, proactive claims management, and data-driven insights that help you prevent losses before they happen.

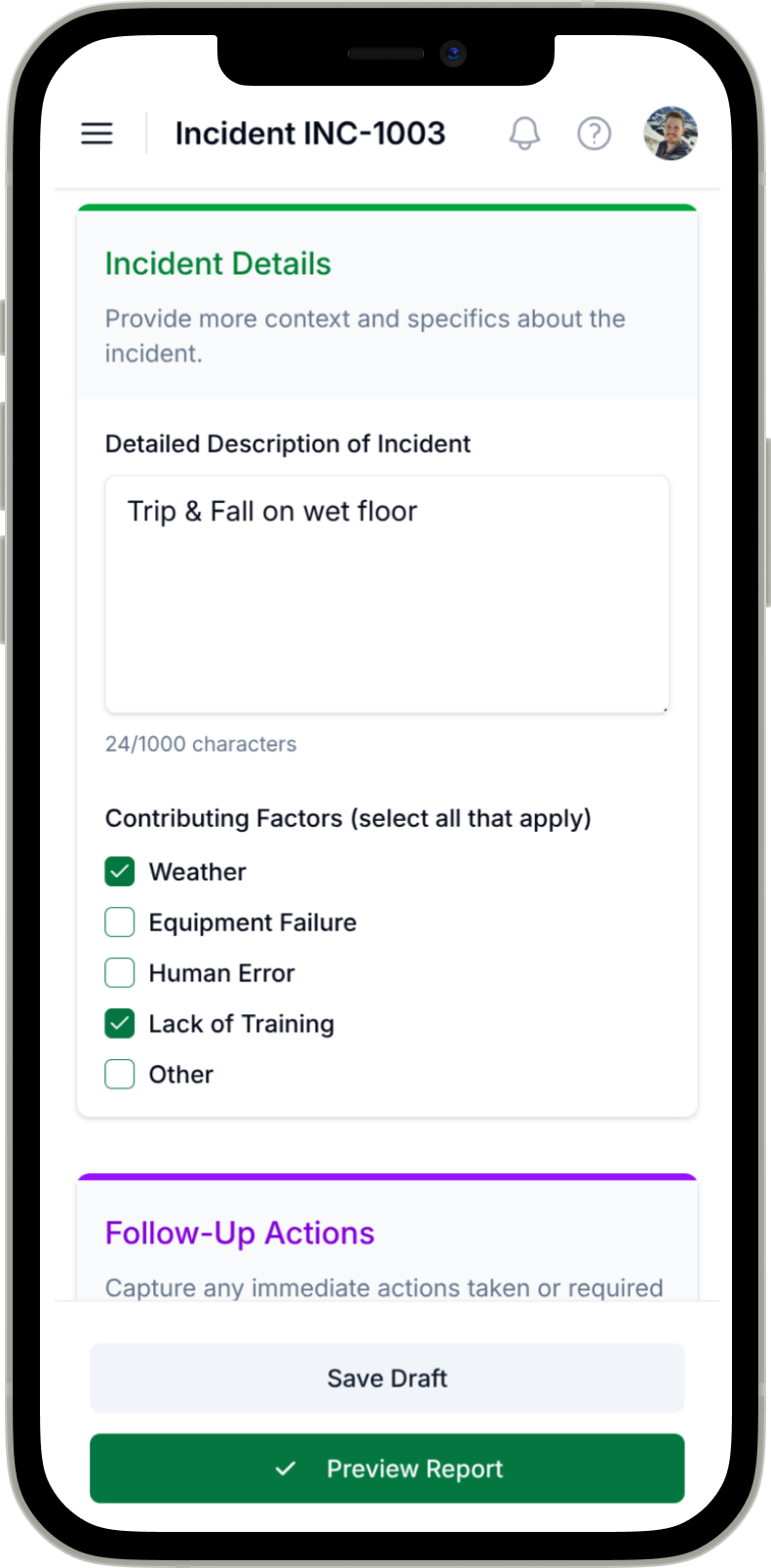

Mobile-First Incident Reporting

Capture Incidents the Moment They Happen

Guide your on-site teams to capture complete, defensible incident reports without the risk of creating liability. Our mobile-first platform ensures you get structured data instantly, not days later.

- Voice-powered reporting.

- Optional AI voice capture lets staff speak naturally while Titan structures the data. No typing, no missed details.

- Instant notifications.

- Risk teams get real-time alerts the moment an incident is filed. No more discovering problems days later.

- Guided data collection.

- Smart prompts ensure all critical information is captured without overwhelming your team or creating legal risk.

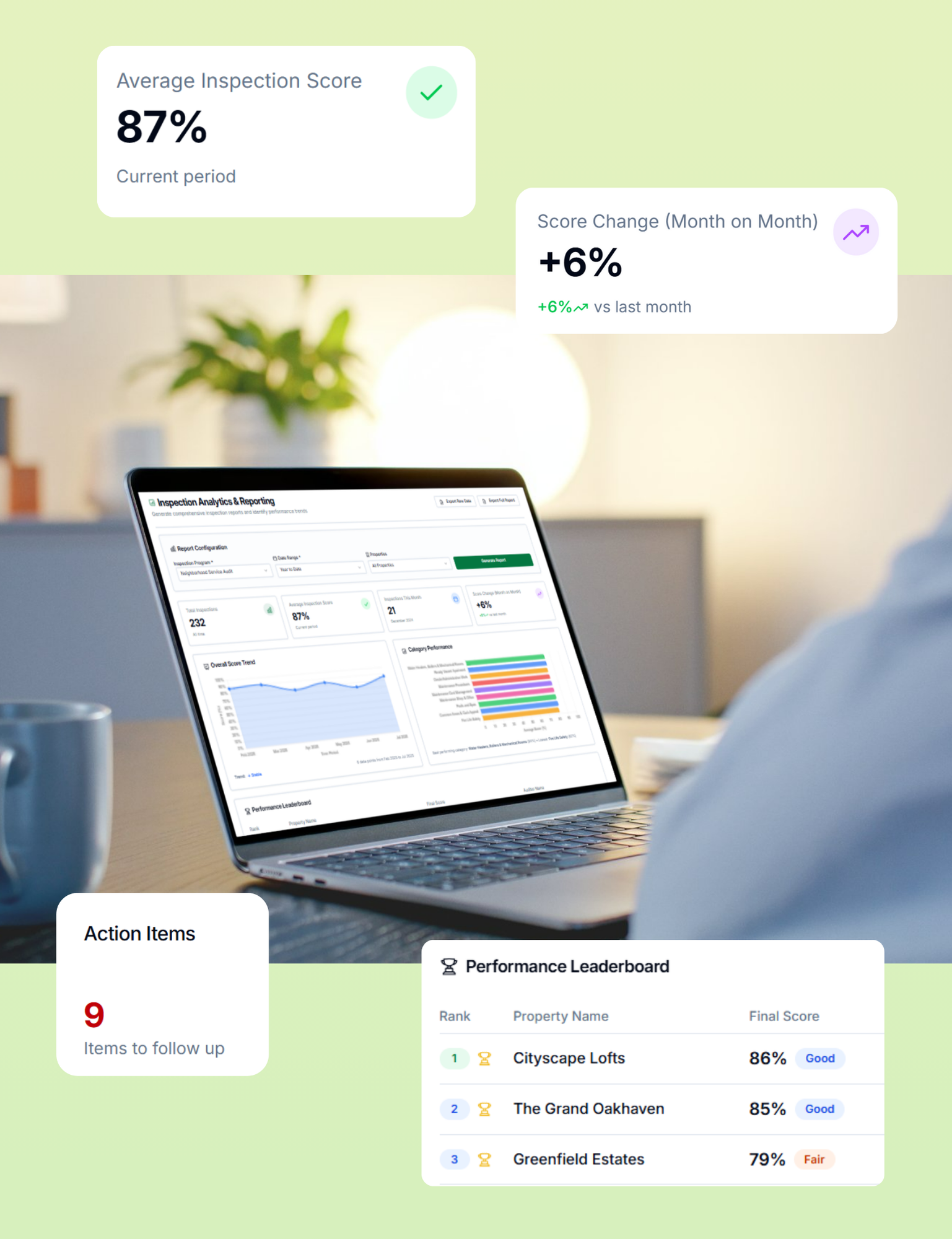

Proactive Risk Prevention

Build a Data-Driven Safety Program

Stop managing inspections with spreadsheets. Digitize your entire process with flexible templates, automated scheduling, and remediation tracking. Use our analytics dashboards to finally understand the root causes of recurring issues.

- Custom inspection templates.

- Create templates for each property type with automated scheduling and mobile notifications for your team.

- Photo documentation.

- Location-tagged photos with automatic organization and easy retrieval for claims or compliance purposes.

- Remediation tracking.

- Track completion of corrective actions with deadline management and automated follow-ups.

Complete Claims Lifecycle Management

Track Every Claim from First Notice to Final Resolution

Monitor reserve development, manage adjuster communications, and maintain complete documentation in one central system. Our AI-powered data entry automates the tedious work while sophisticated analytics help you understand claim patterns.

- Automatic incident-to-claim linking.

- Never lose the connection between the original incident and the resulting claim. Full context from day one.

- Real-time reserve tracking.

- Monitor reserve development and get alerts when reserves exceed thresholds or change unexpectedly.

- Document management with OCR.

- Automatically extract and organize claim documents with searchable OCR and intelligent categorization.

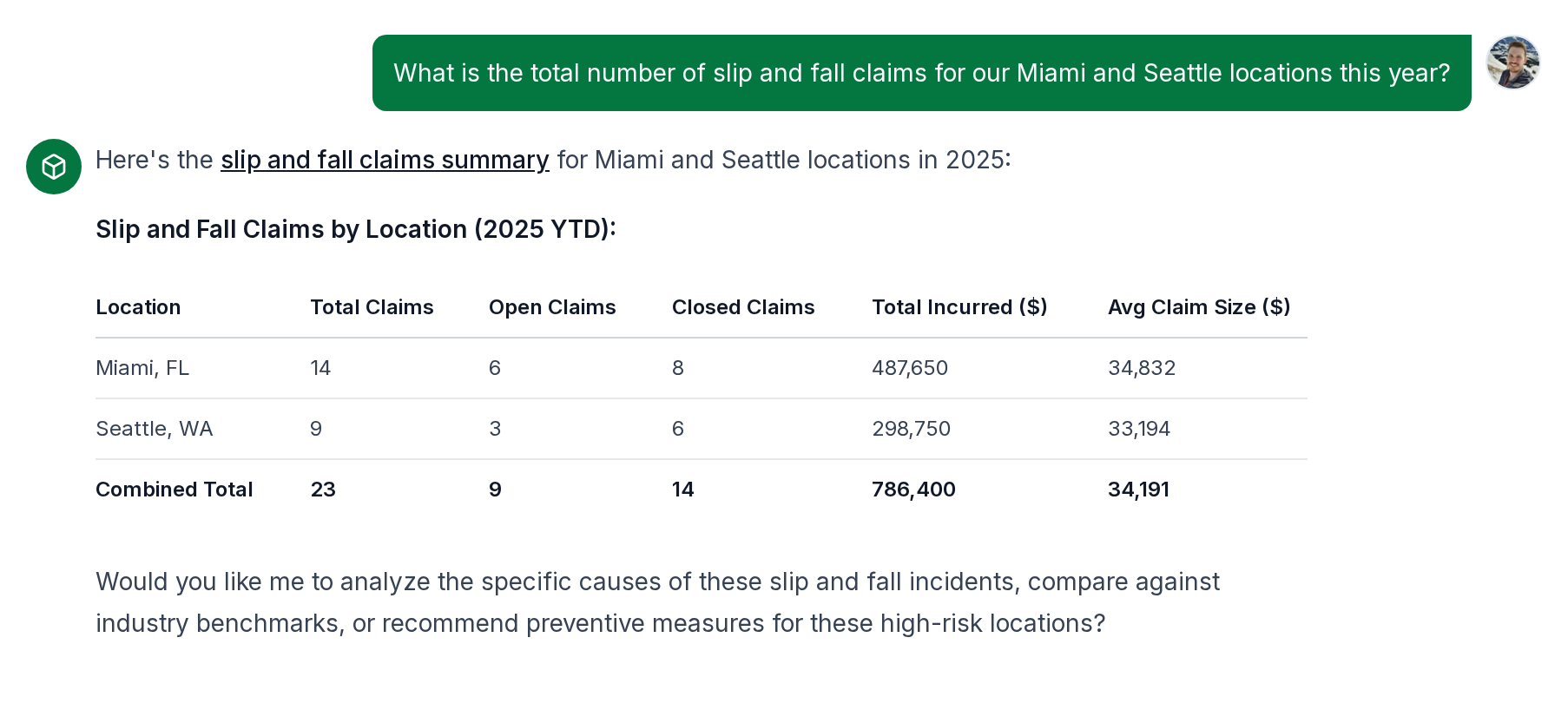

Ask Titan AI: Get Instant Risk Insights

Don't dig through data; just ask. Titan's AI can instantly answer complex questions in plain English, giving your team the insights they need to make faster, smarter decisions.

Powerful, Intuitive, and Built for Results

Titan delivers enterprise-grade capabilities with an intuitive design that reduces your total cost of risk. Quick to deploy, easy to use, and designed to drive immediate value across your entire portfolio.

Simple to Deploy, Powerful to Use

Titan combines enterprise-grade functionality with an intuitive interface that drives adoption across your team. Quick setup means you can be capturing value in days, not months, with full visibility and control from day one.

Proven to Reduce Total Cost of Risk

Titan helps you move from reactive risk management to proactive prevention. By providing better visibility, faster response times, and data-driven insights, you can reduce claim severity, prevent incidents, and demonstrate ROI to leadership and insurers.

Frequently Asked Questions

Titan enhances your existing relationships rather than replacing them. We can integrate with your existing TPAs.

You maintain all existing relationships while gaining the visibility and control that was missing.

Ready to Take Control of Your Portfolio's Risk?

Let's schedule a brief, personalized demo to show you how Titan can transform risk management for your portfolio.